san antonio sales tax rate

Texas residents 625 percent of sales price less credit for. The December 2020 total local sales tax rate was also 63750.

Laura Elizabeth Mayes Lauraelizabethm Twitter

0125 dedicated to the City of San Antonio Ready to Work.

. In California the bottom 20 percent of income earners those earning less than 23200 pay 105 percent in state and local taxes while the top 1 percent those earning. View the printable version of city. San Antonios current sales tax rate is 8250 and is distributed as follows.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The San Antonio New Mexico sales tax rate of 65 applies in the zip code 87832. While many other states allow counties and other.

1000 City of San Antonio. This rate includes any state county city and local sales taxes. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

Texas Comptroller of Public Accounts. Does Texas have sales tax. Ad Find Out Sales Tax Rates For Free.

2020 rates included for use while preparing your income. 1000 City of San Antonio. The minimum combined 2022 sales tax rate for Bexar County Texas is 825.

Ad Find Out Sales Tax Rates For Free. The Fiscal Year FY 2022 MO tax rate is 34677 cents. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables.

Fast Easy Tax Solutions. San Antonios current sales tax rate is 8250 and is distributed as follows. City Sales and Use Tax.

Counties cities and districts impose their own local taxes. The 78216 San Antonio Texas general sales tax rate is 825. The latest sales tax rate for San Antonio TX.

City sales and use tax codes and rates. An alternative sales tax rate of 6375 applies in the tax region Socorro which appertains to zip. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. There is base sales tax by Texas. What is Texass tax rate.

There is no applicable county tax. Download all Texas sales tax rates by zip code. How Does Sales Tax in San Antonio compare to the rest of Texas.

The property tax rate for the City of San Antonio consists of two components. What is the city tax for San Antonio Texas. 0125 dedicated to the.

This is the total of state and county sales tax rates. The average cumulative sales tax rate in San Antonio Texas is 822. San Antonio has parts of it located within Bexar.

Calculator for Sales Tax in the San Antonio. The current total local sales tax rate in San Antonio NM is 63750. Fast Easy Tax Solutions.

What is the sales tax rate in Bexar County. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties. The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to.

The San Antonio sales tax rate is 825. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San. This includes the rates on the state county city and special levels.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Maintenance Operations MO and Debt Service. US Sales Tax.

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Sales Tax By State Is Saas Taxable Taxjar

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding Tax Rate Discrepancies

Texas Sales Tax Guide For Businesses

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

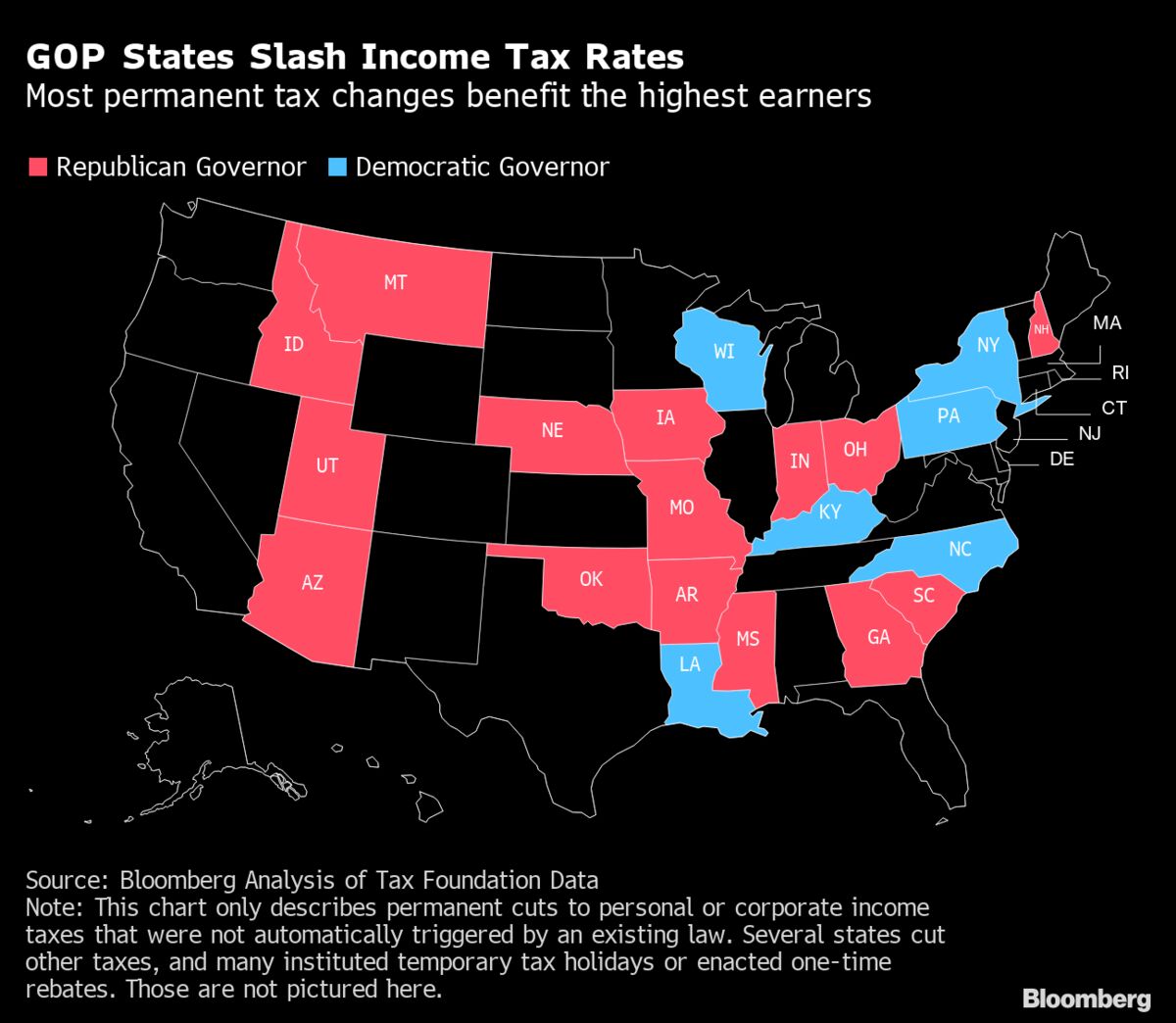

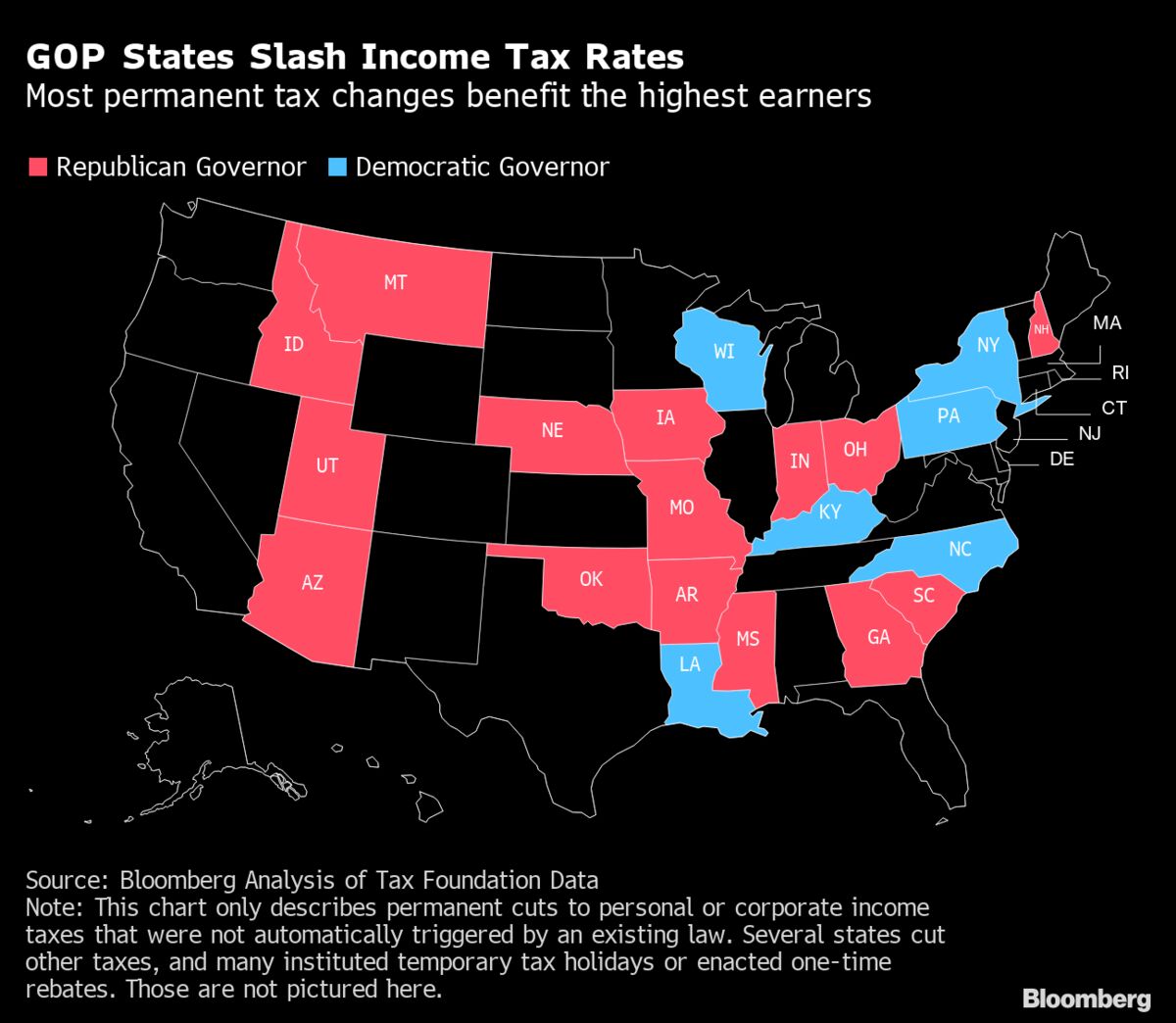

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

Understanding California S Sales Tax

Texas Sales Tax Rates By City County 2022

Understanding California S Sales Tax

Did You Know That The Citizens Of San Antonio Have Voted To Increase Sales Taxes For The City To Purchase And Success Stories Country Roads Water Conservation

Understanding California S Sales Tax

Texans Pay 3 8 More In State Taxes Than Californians I Thought It Was A Low Tax State R Texas